Hey, parents! Studies suggest that children who engage in creative activities are more likely to become innovators and more successful later on in life. So what better way is there to stimulate their creativity and curiosity than by recreating the Wells Fargo fraud in origami, and having them wonder how the heck a company can be so god damn fucked up?

First, we need to cover the background. In 2016 Wells Fargo was charged with multiple lawsuits for opening more than 2 million bank accounts and credit cards between May 2011 and July 2015 without their customers’ knowledge or consent. These charges came after Wells Fargo was forced to break up with its casual girlfriend Fraudulently Certifying Loans For Federal Home Insurance which it dated leading up to the subprime mortgage crisis. That’s when Wells Fargo decided to try being exclusive again with its longtime girlfriend Fraudulently Opening Customer Accounts, which it had been dating for at least as far back as 2005 (Source: New York Times).

The creation of these accounts is attributed to the high pressure sales environment that employees were put under by management to meet unrealistically large sales quotas. Wells Fargo may call itself a bank, but its senior managers are junior sociopaths at best. Every sociopath worth their salt knows you can only psychologically manipulate your targets to do what is in the realm of physical possibility.

Wells Fargo’s strategy was to cross sell multiple products to their customers in order to increase customer loyalty and decrease the likelihood of customers leaving for another bank. Their goal was to have 8 products per customer household. As Senator Elizabeth Warren notes, however, they didn’t run an analysis to determine 8 was the optimal number of products their customers needed. But they didn’t just pull that number out their butts either. 8 was strategically chosen because 8 rhymes with great. Really, that was the reason. This wrote this on page 6 of their 2010 annual report.

They then put this cross selling idea on steroids by expecting workers to meet intense daily quotas. One employee noted that for much of her career salespeople had to sell 8 products per day and at times up to 20 (Source: Fortune). If they didn’t meet their quotas then managers would force them to stay late and make calls into the night. This would lead workers to coerce their family and friends to sign up for accounts so that they could to leave work at a reasonable hour (Source: LA Times).

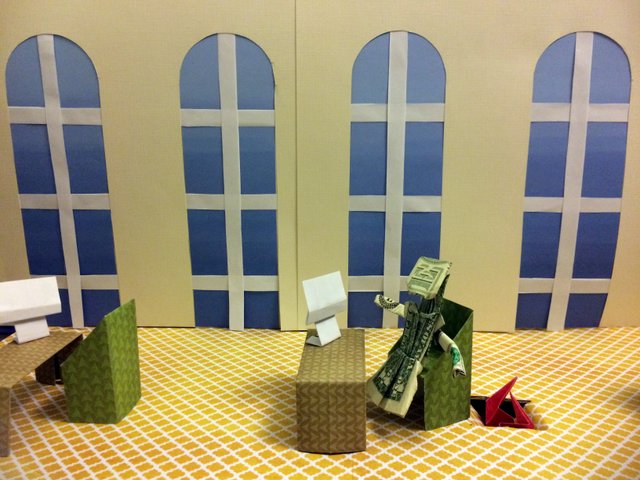

While you build and populate the cubicles of overworked bankers in your first diorama, this is the perfect time to teach your child how to tell a Wells Fargo representative to piss off.

The large sales quotas also led some workers to use manipulative, high pressure sales tactics to make customers sign up for unnecessary accounts. But even if that didn’t work and the customers explicitly rejected the new accounts, some employees secretly signed customers up anyway. If the customer found out about it, Wells Fargo employees might apologize for the problem and claim it was an error with their computer system or someone with a similar name requested it (Source: LA Times). At that point they might just secretly sign that customer up again for another account. As you reenact the events of the fraud in your diorama don’t be afraid to let your child take the wheel and improvise their own scenarios. Chances are they’ll be about as plausible as what actually happened. For example:

- A former employee reported they had to close 26 debit cards for a customer who only wanted one but kept getting signed up for more (Source: LA Times).

- Another customer said he explicitly and repeatedly denied opening a new credit card four times during a visit to the bank. Then he was asked for his mother’s maiden name and, thinking it was related to his current visit to the bank for a wire transfer, gave it out only to discover he was signed up for the god damn credit card (Source: LA Times).

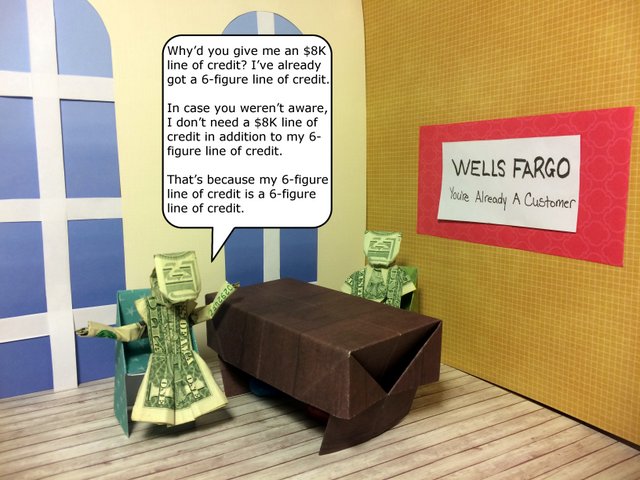

- Another customer recounted she was secretly signed up for an $8K line of credit when she already had a 6-figure line of credit (Source: LA Times).

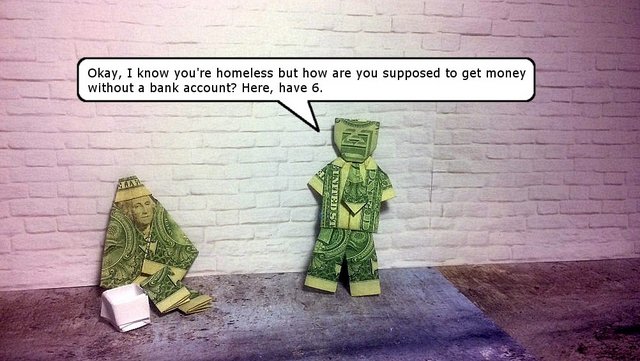

But some claims were even worse. As the LA Times reported, “One former branch manager who worked in the Pacific Northwest described her dismay at discovering that employees had talked a homeless woman into opening six checking and savings accounts with fees totaling $39 a month.”

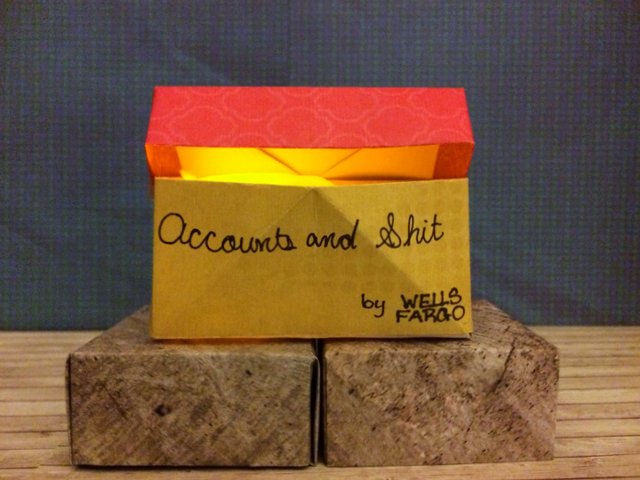

Additionally, former employees noted that they’d go to blood banks to pressure people into opening accounts (Source: LA Times). I know blood bank has the word bank in it, but typically people selling their blood don’t have a lot of money to begin with. I mean they were really scraping the bottom of the barrel there. On top of that Wells Fargo apparently thought college students had money so they travelled to campuses and opened up fake accounts for them (Source: The Atlantic). But going to college students and looking for money is like going to Wells Fargo and looking for accountability. I guess we’ve already established they have questionable decision making skills after the whole charging a homeless woman $40 a month in fees thing. According to other former employees, Wells Fargo targeted elderly customers with memory problems and immigrants who spoke poor English since they put up the least resistance (Source: New York Times). This is all to say Wells Fargo was essentially the worst version of Santa Claus who regardless of whether you’re good or bad gives you a bunch of unnecessary crap and then sends you the bill for it. Actually they could probably make a subscription box out of it.

Accounts and Shit – the subscription box from Wells Fargo. Each month receive a specially curated surprise from your friends at Wells Fargo containing anything from new debit cards, a lower credit rating, anti-anxiety medication, overdraft fees, and a seven-minute conversation with a persistent bank teller who won’t take “no” for an answer. Order within the next 10 minutes and receive 5% off your first order and an additional 5% off your credit score.

This is a good time to remind your child of researching companies before applying to work for or doing business with them. This can be used to gauge their corporate ethics and culture. Websites that provide worker testimonials can be used to spot red flags. Additionally, your child should perform a name analysis on the company to determine if the words “Wells Fargo” are in it. If they do, steer clear.

According to CNNMoney, in order to hide the existence of these accounts from customers, employees “would impersonate their customers and ‘input false generic email addresses such as 1234@wellsfargo.com, noname@wellsfargo.com, or none@wellsfargo.com.’” Additionally, “branch and district managers told [an employee] to falsify the phone numbers of angry customers so they couldn’t be reached for the bank’s satisfaction surveys.”

An alternative to falsifying the phone numbers of angry customers was to not treat their customers like shit, which behavioral experts predict would lead to a significant decrease the number of angry callers.

The pressure to meet selling quotas at Wells Fargo was reinforced with constant meetings throughout the day. As one person described to the LA Times:

“The tracking starts each morning. Managers are asked not only to meet but to exceed daily quotas passed down by regional bosses. Branch managers are expected to commit to 120% of the daily quotas, according to the former Pacific Northwest branch manager, who said results were reviewed at day’s end on a conference call with managers from across the region.

‘If you do not make your goal, you are severely chastised and embarrassed in front of 60-plus managers in your area by the community banking president,’ the former branch manager said.”

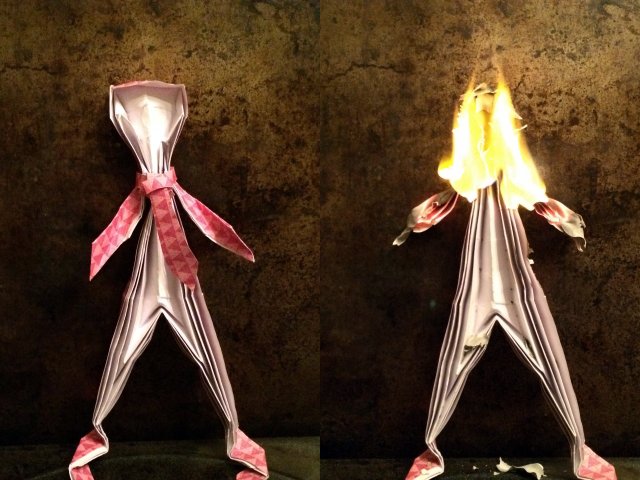

That pressure was pushed down to front line workers. As Fortune reported, a former salesperson identified only as ” ‘Ashley’ recounts some familiar parts of the story, including the bank’s steep sales goals…. When she didn’t meet her quotas, Ashley says she would be subjected to humiliating ‘coaching sessions’ and warned that she would be fired if she didn’t do better. She describes vomiting at her desk from the stress.”

It can be very stressful to read about the events of the Wells Fargo fraud so we recommend a few deep breaths now, and then burn origami effigies of managers.

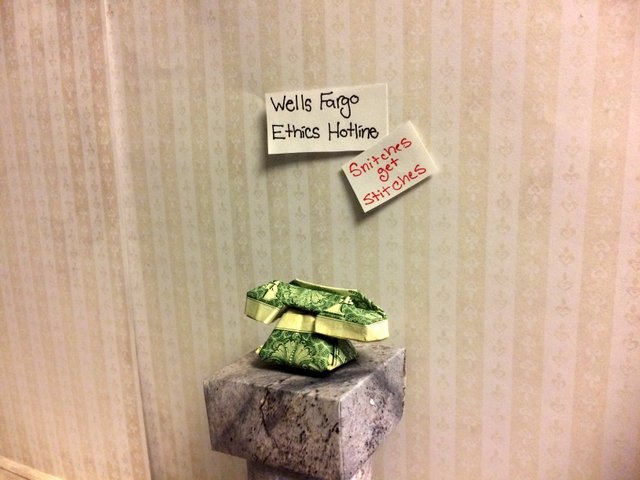

You might be wondering where the fraud, waste, and abuse hotlines were in all of this. Well, they were there but in some cases did the opposite of what they were expected to do. Numerous allegations have been brought against Wells Fargo for improper terminations of employees who reported shady business practices at their branches. As one human resources worker describes:

“the bank had a method in place to retaliate against tipsters. … Wells Fargo would find ways to fire employees ‘in retaliation for shining light’ on sales issues. … ‘If this person was supposed to be at the branch at 8:30 a.m. and they showed up at 8:32 a.m, they would fire them’” (Source: CNNMoney).

It’s like they set up the ethics hotline as a trap to catch weak employees who were not committed to the cause.

This environment left some managers in the advantageous position to be able to fire anyone who didn’t commit fraud for failing to meet their sales quota, but also fire anyone who did commit fraud for breaking the law. And they did just that.

In your own diorama try creating a trap door under your employees’ desk that leads to a fiery death below in order to recreate the power you hold over them. As an employer, this is known as a win-win situation.

Also teach your child about the importance of getting out of situations where they can be screwed no matter what they do. Remind them that if they are ever in a situation like this they need to document everything shady they see and are told to do, this way they can cover their back. This includes getting their directives in writing or if they receive their directives verbally, they should send an email to their supervisor to follow up and confirm their instructions, and make sure that they understood everything they’ve been told to do.

Alternatively they could not work at Wells Fargo.

The whole situation was pretty messed up. But like the television network Bravo it kept setting a new low. Some managers didn’t stop at firing an employee for whistleblowing. They branded some whistleblowers for improprieties in the employees’ U5 reports, which are essentially a report card for bankers that show potential employers a candidate’s character and legal history. Because of getting bad marks in their U5s, former employees couldn’t get jobs at other banks. In discussions with NPR the employees “say this amounted to a scarlet letter that has badly damaged their careers.”

I know it’s messed up. Just keep breathing.

In addition to the general fuckery listed above towards customers and employees, whenever a customer’s credit score is checked by a bank (such as when a credit card is opened) it can hurt that person’s credit score. If a customer’s credit score was lowered as a result of a fake credit card getting opened, and that customer later applied for a loan, their lowered credit score could result in them getting a higher interest rate on that loan. This could have dramatic implications on the customer and drastically increase the amount of interest expense they pay on their loan. For example, if the customer’s loan interest rate jumps from 3.5% to 4% as a result of a fraudulent credit card being opened, and they take out a $500,000 30-year fixed mortgage loan, the customer would be required to pay an additional $50,000 in interest.

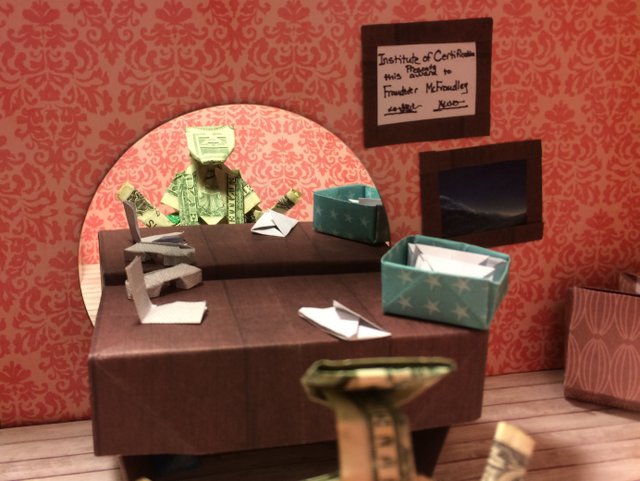

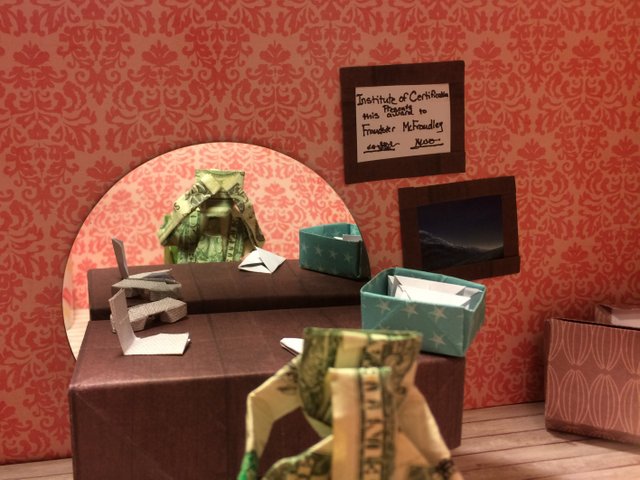

There are many ways to depict federal regulators in a fraud diorama. The Office of the Comptroller of the Currency is an independent bureau tasked with chartering and regulating national banks, and in a 15-page report on the fraud they determined they “did not take timely and effective supervisory actions after the bank and the OCC identified significant issues with complaint management and sales practices.” For example, the OCC was aware of 700 whistleblower complaints related to sales tactics as far back as 2010 but they “failed to document the resolution of whistleblower cases” (Sources: OCC, and NY Times).

We depict them in the following manner:

Alternatively you could take a roll of toilet paper and write “regulative action” on it.

Ultimately the LA Times brought this story to a head. When the story broke, Wells Fargo senior executives responded swiftly and took responsibility for creating the high pressure sales environment that led to this fraud. Lol, just kidding.

Wells Fargo consistently said the problem was not widespread despite firing 5,300 employees or 1% of its workforce over the course of several years and across the country. They additionally denied that there was a culture problem despite the reams of ethics line complaints. In your own diorama, this is a perfect time to practice your the problem is not widespread response to the public.

But then Wells Fargo showed some responsibility for the fraud after there was too much evidence for them to continue downplaying it.

Now, try to practice your oh god so now there’s no doubt that the problem was widespread response to the public.

Beyond this brief summary of the fraud, Wells Fargo continues to face lawsuits and regulatory probes regarding its sales practices, promising many more opportunities for origami to come. By now though, you and your child will have bonded so much they’ll tell all their friends at school “I don’t need to listen to music with swear words in it because I have cool parents.”

While Orange Stripe recreated multiple events from the fraud we encourage you to choose any moments that inspire you and recreate those on your own. We highly recommend incorporating money in your origami as well because what more appropriate way is there to recreate a fraud than by using money and pressure?

Well, I suppose the parents could make the dioramas and have their kid turn it in for a school project.